Credit Insecurity Index

Index (0-100) reflecting community-level limited credit access

Why do we measure credit insecurity?

Credit insecurity is a measure of limited access to credit and an important marker of a community’s financial health. The ability to access credit when needed supports people’s financial security and helps them take advantage of other economic opportunities, like buying a home or getting a job. Those with limited access to credit may have trouble borrowing money for future opportunities or accessing the money needed for unexpected emergencies.5

Credit insecurity has been connected to poor mental health outcomes, such as mental distress, suicidal ideation, opioid use, and binge drinking,8 as well as to decreased use of preventive healthcare services.6 It can also indicate how well a community’s financial health may recover following economic downturns.2,5,7 Understanding which geographic areas are credit insecure can help governments and community stakeholders allocate resources in advance of emergencies. Credit insecurity is more timely than many other indicators of economic well-being because it captures economic distress at earlier stages and because the data behind it are updated more frequently.

Measuring credit insecurity can also inform interventions aimed at increasing racial equity. High-cost loans and lack of access to mainstream financial institutions are more common in Black and Latino neighborhoods, furthering the potential for racial inequality in access to credit and associated downstream effects.3,4 Tracking the Credit Insecurity Index creates an opportunity for city and community leaders to assess interventions such as increasing uptake of public benefits like Medicaid1,5 and regulating lending policies.3

How do we measure credit insecurity?

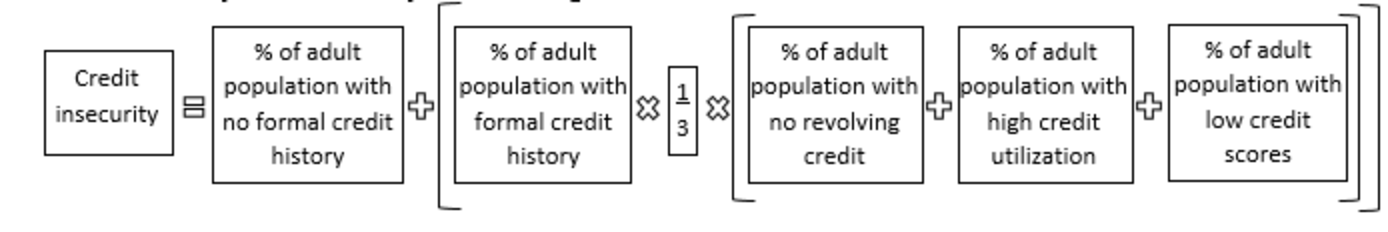

The Credit Insecurity Index reflects the proportion of local residents who have limited access to credit, either because they have no or poor credit history. Individuals with no credit history do not have a credit score and typically are not connected to mainstream credit institutions, such as banks or credit unions. Individuals with poor credit history are those with low credit scores, without revolving credit (such as a credit card), or with most of their available credit already in use. The Credit Insecurity Index takes both these categories of people into account to provide a measure of credit access in the community as a whole. Higher Credit Insecurity Index values mean that a community is more credit constrained.

Strengths of Metric | Limitations of Metric |

• The Credit Insecurity Index is based on timely and spatially granular data to reflect current economic conditions. • Credit insecurity is related to important mental health outcomes.

| • Credit insecurity is highly correlated with other similar economic measures. • Demographic breakdowns are unavailable for this metric. • The metric combines several credit-related outcomes into a single index, which may make it harder to interpret. |

Calculation

Credit insecurity is calculated by the following formula:

For more information on the calculation, please refer to the City Health Dashboard Technical Document.

Data Source

Estimates for this metric are from 2020 from The New York Federal Reserve Bank Consumer Credit Panel and Equifax.

Years of Collection

Data from 2020.

References

Caswell, K. J. and T. A. Waidmann (2019). The affordable care act Medicaid expansions and personal finance. Med Care Res Rev, 76(5): 538-571.

Weida EB, Phojanakong P, Patel F, Chilton M (2020) Financial health as a measurable social determinant of health. PLoS ONE 15(5): e0233359. https://doi.org/10.1371/journal.pone.0233359

Faber, J.W. (2018) Segregation and the geography of creditworthiness: Racial inequality in a recovered mortgage market. Housing Policy Debate, 28:2, 215-247, DOI: 10.1080/10511482.2017.1341944

Faber, J. (2019). Segregation and the cost of money: Race, poverty, and the prevalence of alternative financial institutions. Social Forces, 98. 819-848. 10.1093/sf/soy129.

Hamdani, K., et al. (2019). Unequal access to credit: The hidden impact of credit constraints. Federal Reserve Bank of New York.

Kentikelenis, A., et al. (2011). Health effects of financial crisis: omens of a Greek tragedy. Lancet 378(9801): 1457-1458.

Marmot M. G., Bell R. How will the financial crisis affect health? BMJ 2009, 338 :b1314 doi:10.1136/bmj.b1314

Richardson, T., et al. (2013). The relationship between personal unsecured debt and mental and physical health: A systematic review and meta-analysis. Clinical Psychology Review, 33(8): 1148-1162.

Last updated: July 26, 2023